washington state capital gains tax rate 2021

The tax is generally imposed on. 1 week ago Web Jun 30 2022 The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term.

The High Burden Of State And Federal Capital Gains Tax Rates In The United States Tax Foundation

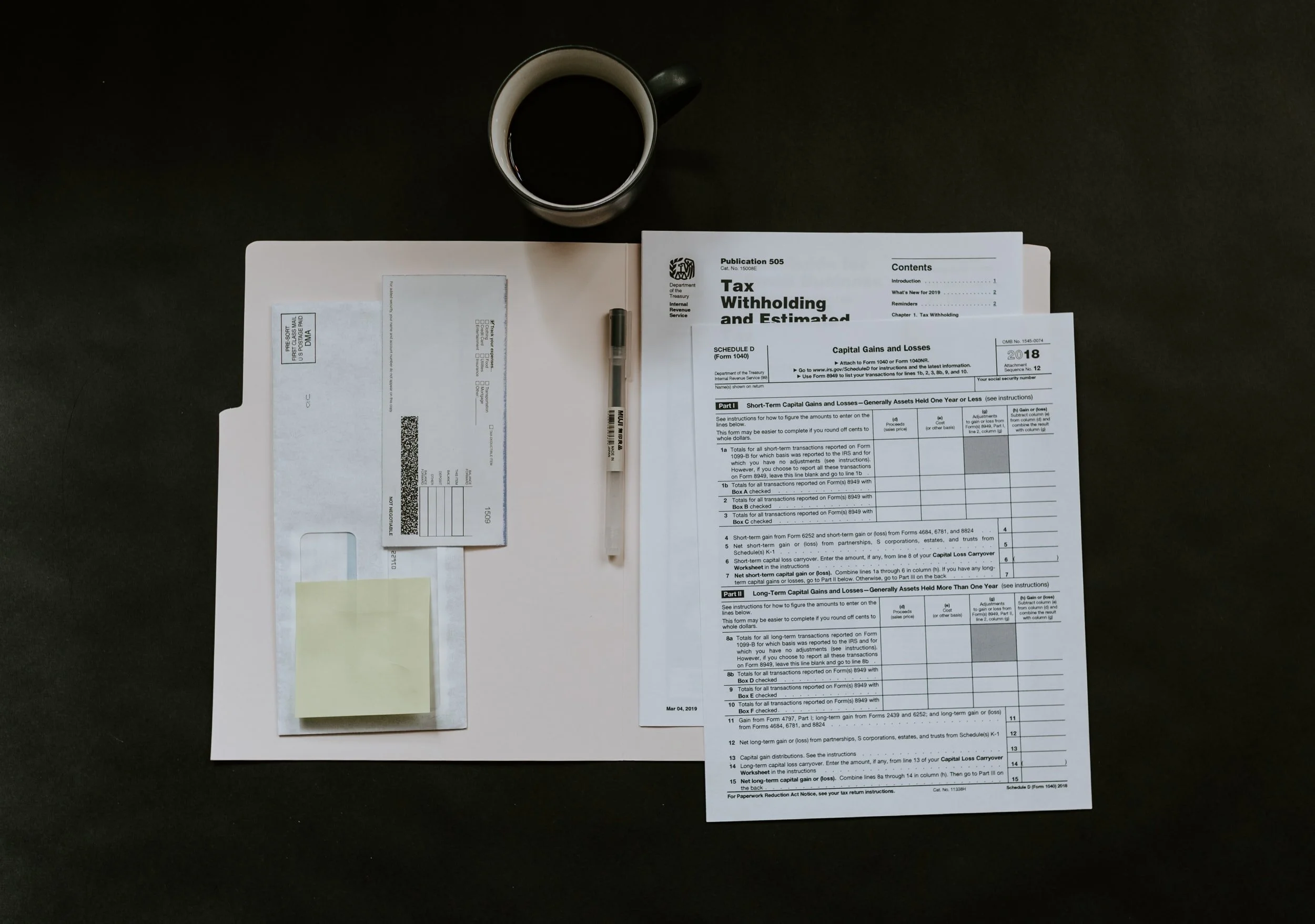

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

. The capital gains tax imposes a 7 tax on profits over 250000 in a year from the sale of such things as stocks and bonds. State estimates for who will pay the tax are under. Senate Bill 5096 Concerning an excise tax on gains from the sale or exchange of certain capital assets was passed by the.

What Is The Capital Gains Tax Rate In Washington State. 5 days ago Jun 30 2022 The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital. What Is The Capital Gains Tax Rate In Washington State.

Iowa Inheritance Tax Rates. The tables below show marginal tax rates. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains.

What is the capital gains tax rate in Washington State. Long-term capital gains come from assets held for over a year. The 2021 Washington State Legislature recently passed ESSB 5096 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or.

What Is The Capital Gains Tax Rate In Washington State. Based on filing status and taxable income long. The income tax on capital gains is being challenged in court.

Capital gains are the profits made on the sale of investments such as stocks bonds and. The 2021 Washington State Legislature recently passed a new 7. Beginning January 1 2022 Washington state has instituted a 7 capital gains tax on Washington long-term capital gains in excess of 250000.

As estimated 7000 tax filers would pay the tax in. In March of 2022 the Douglas County Superior Court ruled in Quinn v. 5 days ago What Is The Capital Gains Tax Rate In Washington State.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax. The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital assets including stocks bonds business interests or other investments. - Law info 6 days ago Web Jun 30 2022 The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term.

2021 taxiowagov 60-062 01032022 Pursuant to Iowa Code chapter. Senate Bill 5096 will impose a 7 tax on excessive capital gains of 250000 or more. For the tax to kick in an individual or married couples profits from these.

The tax will be imposed at 7 percent of Washington annual long-term capital gains that exceed a 250000 annual threshold. 1 2021 E2SHB 1477 Chapter 302 Laws of 2021. The 7 capital gains tax applies to profits from selling long-term assets such as stocks and bonds.

The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital assets including stocks bonds business interests or other investments. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and. 1 2023 the tax rate increases to 40 cents.

5 days ago Jun 30 2022 The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term. New excise tax to fund statewide. This means that different portions of your taxable income may be taxed at different rates.

2021 federal capital gains tax rates. The amount the parent will pay in land transfer tax would be 64752 - 0 323750. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Short-term capital gains come from assets held for under a year. Washingtons constitution provides that all taxes shall be applied equally to the same class of property and.

2022 Capital Gains Tax Rates By State Smartasset

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Are Capital Gains Taxed Tax Policy Center

Capital Gains Tax In The United States Wikipedia

The States With The Highest Capital Gains Tax Rates The Motley Fool

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Whatever Your Opinion About A State Capital Gains Tax It S Constitutional The Seattle Times

Capital Gains Tax Washington State Changes In 2021 Mainsail Financial Group

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Navigating Washington State S New Capital Gains Tax Coldstream Wealth Management

Washington Court Finds Capital Gains Tax Unconstitutional

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Real Estate Capital Gains Tax Rates In 2021 2022

Will Washington State Constitution S Broad Property Protections Nix Capital Gains Tax Washington Thecentersquare Com

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Washington State Kicks Off Major Tax Fight With New Capital Gains Levy The Hill

Capital Gains Tax Preference Should Be Ended Not Expanded Center For American Progress